Unknown Facts About Paul B Insurance Local Medicare Agent Melville

They incorporate original Medicare (Medicare Part A and Medicare Part B) protection as well as commonly provide fringe benefits. Many Medicare Advantage plans use the following benefits: There are different kinds of Medicare Advantage intends to select from, consisting of: HMO plans utilize in-network doctors as well as call for referrals for experts. PPO plans bill various rates based upon in-network or out-of-network services.

SNPs assist with lasting medical expenses for chronic problems - paul b insurance Medicare Supplement Agent melville. MSA strategies are clinical savings accounts combined with high insurance deductible wellness plans. Contrasted to original Medicare, there might be benefits if you choose a Medicare Advantage strategy. Original Medicare only provides two kinds of insurance coverage: medical facility insurance coverage and also clinical insurance policy. If you desire added insurance coverage, you'll require to acquire Medicare Component D for prescription drug protection and Medigap for supplementary insurance coverage.

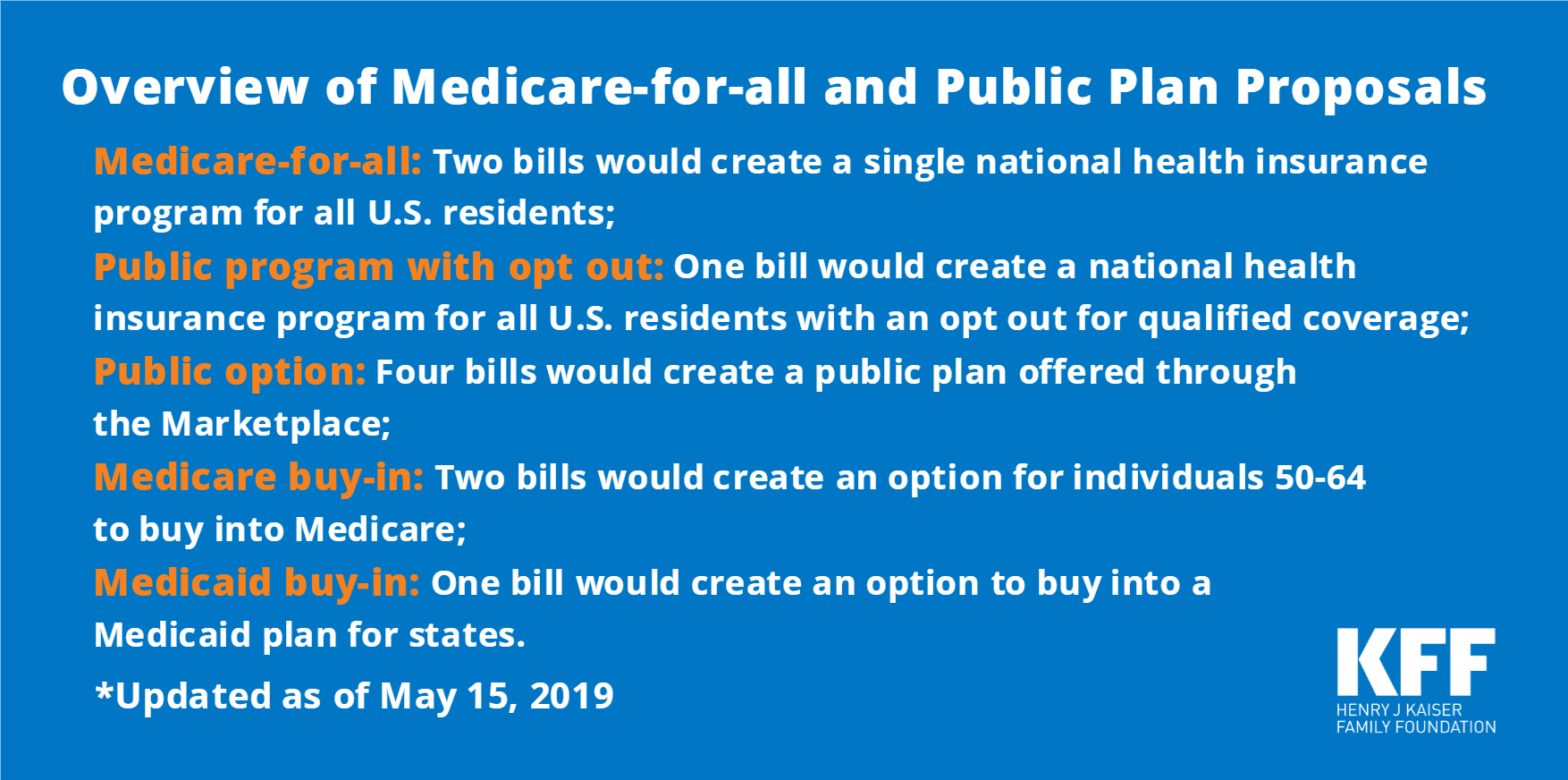

Not known Incorrect Statements About Paul B Insurance Medicare Health Advantage Melville

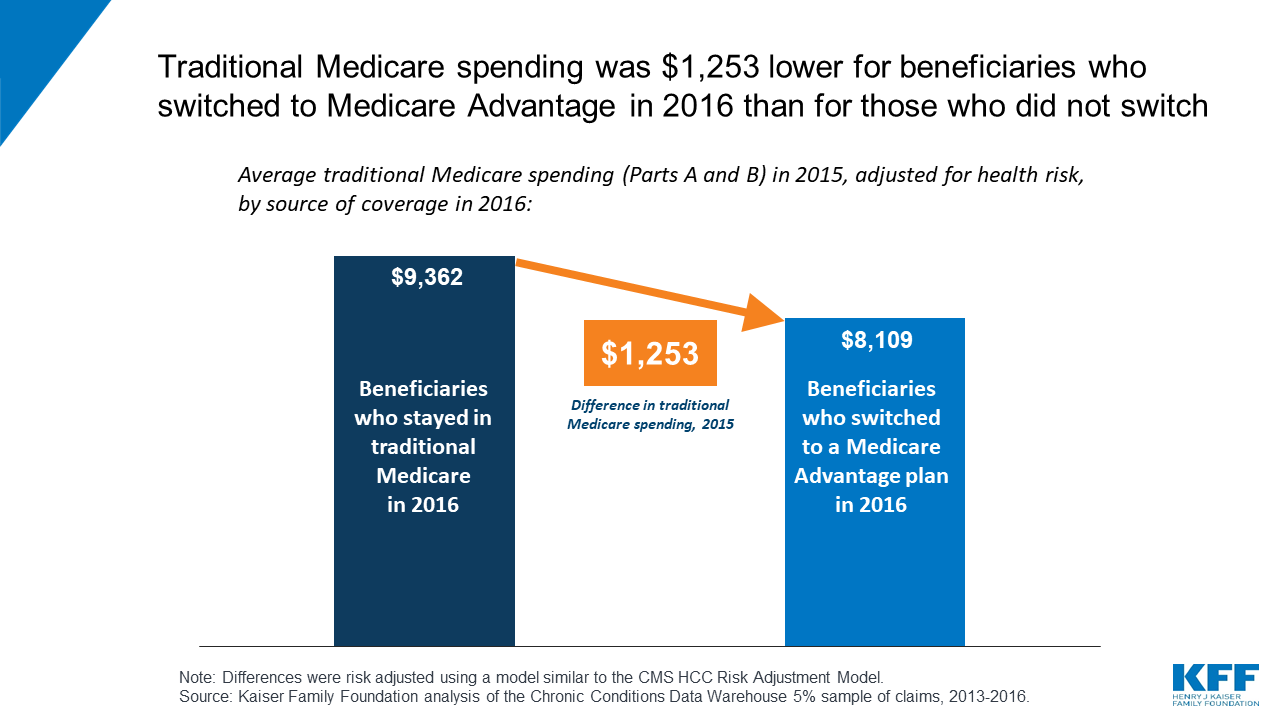

Another benefit of choosing Medicare Advantage is that many strategies established restrictions on the optimum out-of-pocket expenses you'll pay throughout a plan year. Has actually revealed that you might save cash on lab services and clinical tools by changing to a Medicare Advantage plan. If you select a Medicare HMO strategy, you might see much more cost savings on medical care solutions provided by your HMO network.

This indicates that your medical care suppliers proactively connect to collaborate your care in between various sorts of healthcare services and medical specialties. This guarantees you have a medical care team and assists avoid unneeded cost as well as concerns like medication communications. In one, scientists discovered that coordinated care was connected with higher client scores and more favorable clinical team experiences.

The 30-Second Trick For Paul B Insurance Medicare Agency Melville

If you select one of the more preferred Medicare Advantage plan kinds, such as an HMO strategy, you may be restricted in the carriers you can see. You will generally deal with higher fees if you pick to an out-of-network supplier with these plans. Various other strategy types do offer you extra company liberty, though those plans may have greater premiums as well as charges like copays and also deductibles.

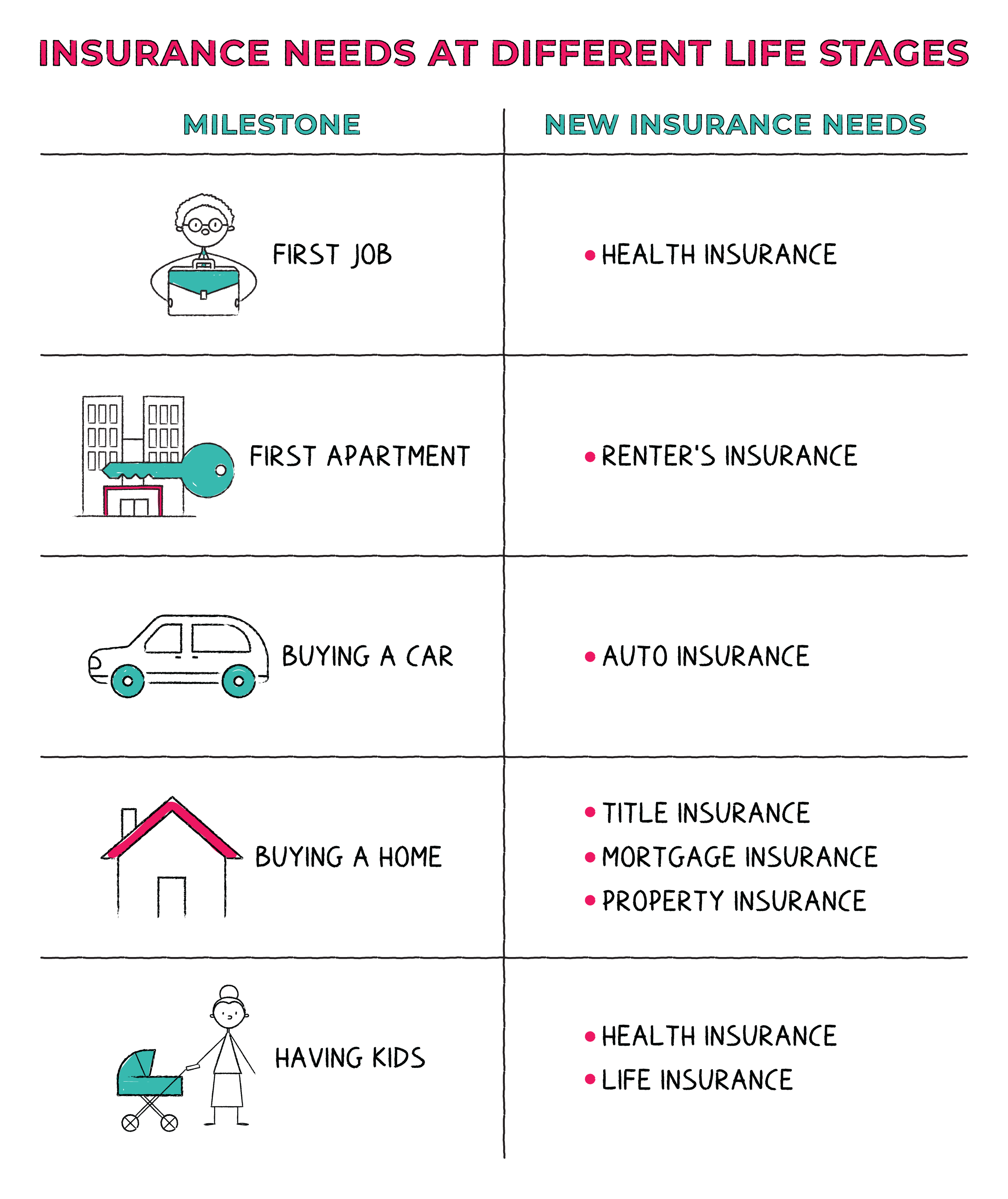

establish your spending plan just how much you can afford to invest on premiums as well as out-of-pocket costs. Some strategies do supply $0 costs and also deductibles, however others might bill a couple of hundred bucks. If you take medication, you'll require to find a Benefit strategy that consists of prescription medication insurance coverage or buy a Part D plan. Several Advantage plans consist of added protection such as dental, vision, and also hearing. You can speak to carriers to see what their.

strategies have to provide. Greater than 40 percent of Americans have chronic health problems. You'll additionally wish to consider which strategy will match your lasting medical needs the best. If maintaining your existing healthcare service provider is important to you, you will certainly require to know what Medicare strategies they accept or join. The CMS star rating actions things like management of persistent problems, availability of care, participant experience and issues, client solution, medication rates, as well as a lot more. CMS launches its celebrity ratings yearly. Medicare Advantage supplies several benefits to initial Medicare, consisting of hassle-free coverage, multiple strategy choices, and also long-lasting cost savings. There are some disadvantages also, consisting of company restrictions, additional expenses, and also absence of coverage while taking a trip. The info on this web site may aid you in making personal decisions regarding insurance, however it is not planned to give guidance relating to the acquisition or use any kind of insurance policy or insurance products. Healthline Media does not negotiate business of insurance in any kind of fashion and also is not certified as an insurance provider or manufacturer in any U.S. Healthline Media does not suggest or back any kind of third celebrations that may transact business of insurance coverage. Medicare is the federal medical insurance program created in 1965 for individuals ages 65 and also over, regardless of revenue, medical background, or wellness standing. The program was increased in 1972 to cover particular

individuals under age 65 that have a long-lasting special needs. Today, Medicare plays an essential duty in supplying health and wellness and financial official site security to 60 million older individuals as well as more youthful individuals with specials needs. In 2017, Medicare costs represented 15 percent of overall government investing and 20 percent of total national health and wellness costs. The majority of people ages 65 and also over are entitled to Medicare Component A if they or their spouse are eligible for Social Safety and security

payments, and also do not have to pay a premium for Component A if they paid pay-roll taxes for 10 or even more years. Almost two million recipients(3% )lived in a lasting care center. In 2016, half of all individuals on Medicare had earnings below $26,200 each as well as financial savings listed below $74,450. Number 1: Attributes of the Medicare Populace Medicare covers many health and wellness solutions, consisting of inpatientand also my response outpatient hospital care, medical professional solutions, and prescription drugs(Number 2). Part An advantages undergo a deductible($ 1,364 per advantage duration in 2019). Component An also requires coinsurance for prolonged inpatient health center and SNF stays. covers physician sees, outpatient solutions, preventive solutions, and also some house wellness check outs. Several Part B advantages undergo

a deductible($185 in 2019), and, commonly, coinsurance of 20 percent. Preventive Services Task Force, such as mammography or prostate cancer screenings. refers to the Medicare Advantage program, through which recipients can register in an exclusive health insurance, such as a health care organization(HMO)or favored company organization( PPO ), as well as obtain all Medicare-covered Part An as well as Part B advantages as well as generally likewise Part D advantages. Figure 3: Total Medicare Private Health Insurance Plan Registration, 1999-2018 covers outpatient prescription drugs through personal strategies that agreement with Medicare, including stand-alone prescription medication strategies (PDPs) as well as Medicare Advantage plans with prescription drug protection(MA-PDs ). In 2019, beneficiaries have a choice of 27 PDPs and 21 MA-PDs, generally. The Part D benefit assists spend for enrollees'medicine costs and also gives coverage for extremely high drug costs. Enrollees pay monthly costs as well as expense sharing for prescriptions, with expenses varying by strategy. Registration in Part D is volunteer; in 2018, 43 million people on Medicare were registered in a PDP or MA-PD.Of this total, approximately one in 4 get low-income subsides. Medicare offers protection versus the prices of

many health and wellness treatment services, however traditional Medicare has fairly high deductibles and also cost-sharing demands and places no restriction on recipients 'out-of-pocket spending for services covered under Components An as well as B. Because of her latest blog Medicare's benefit spaces, cost-sharing requirements, as well as lack of an annual out-of-pocket costs limitation, a lot of beneficiaries covered under conventional Medicare have some type of supplemental protection that helps to cover recipients 'expenses as well as load the advantage voids( Figure 4). Number 4: Distribution of Kinds of Supplemental Coverage Among Recipients in Traditional Medicare in 2016 Employer-sponsored insurance supplied retired person health and wellness insurance coverage to 3 in 10(30%)of traditional Medicare recipients in 2016. Medigap, likewise called Medicare supplement insurance, given extra insurance coverage to virtually 3 in 10(29%)beneficiaries in standard Medicare in 2016. These plans are offered by exclusive insurance provider and also totally or partly cover Part An and also Component B cost-sharing needs, consisting of deductibles, copayments, and coinsurance. Medicaid, the federal-state program that gives protection to low-income individuals, wasa source of extra insurance coverage for even more than 1 in 5(22%, or 7. 5 million beneficiaries that were enlisted in both Medicare Benefit and Medicaid). These recipients are understood as dually eligible beneficiaries since they are qualified for both Medicare and Medicaid. The majority of typical Medicare recipients that obtain Medicaid(5. 3 million)receive both complete Medicaid advantages, consisting of long-lasting solutions and also supports, and repayment of their Medicare premiums and also cost sharing. 7 million recipients do not qualify for full Medicaid advantages but Medicaid covers their Medicare costs and/or price sharing through the Medicare Financial Savings Programs. Nearly 1 in 5(19%, or 6 million)Medicare beneficiaries with conventional Medicare had no supplementary insurance coverage in 2016. These 6 million beneficiaries are totally exposed to Medicare's cost-sharing needs as well as do not have the protection of a yearly restriction on out-of-pocket spending, unlike recipients enrolled in Medicare Benefit.